Businesses facing the threat of data breaches are increasingly recognizing the importance of PCI compliance certification to protect their operations and reputation. Recent incidents involving major companies like Equifax, Target, and British Airways have highlighted the devastating impact that data breaches can have on businesses. Research from the National Cyber Security Alliance reveals that 60% of small businesses shut down within six months of experiencing a data breach. To mitigate this risk and instill confidence in customers, PCI compliance certification is crucial.

PCI DSS (Payment Card Industry Data Security Standards) certification is a global security standard established by the PCI SSC (Payment Card Industry Security Standards Council) for organizations involved in the storage, processing, or transmission of cardholder data. This standard encompasses stringent security measures such as firewall installation, encryption of data transmissions, and the use of antivirus software. Achieving PCI compliance certification signifies to customers that a business has implemented robust security protocols to safeguard cardholder data, reassuring them of the company’s trustworthiness.

The mandatory nature of PCI compliance certification is underscored by the requirement for organizations processing major credit card brands like Mastercard, Visa, Discover, American Express, and JCB to demonstrate compliance. Failure to comply with PCI standards can result in severe financial and reputational consequences for businesses. Therefore, obtaining PCI compliance certification is not merely a formality but a critical aspect of ensuring the security and integrity of cardholder data.

To navigate the process of obtaining PCI compliance certification, businesses must first understand the detailed requirements outlined in the PCI DSS. These requirements include setting up and maintaining firewall configurations, using unique system passwords, securing stored cardholder data, encrypting data transmissions, employing antivirus software, limiting access to cardholder data, and implementing robust security measures across various aspects of the organization.

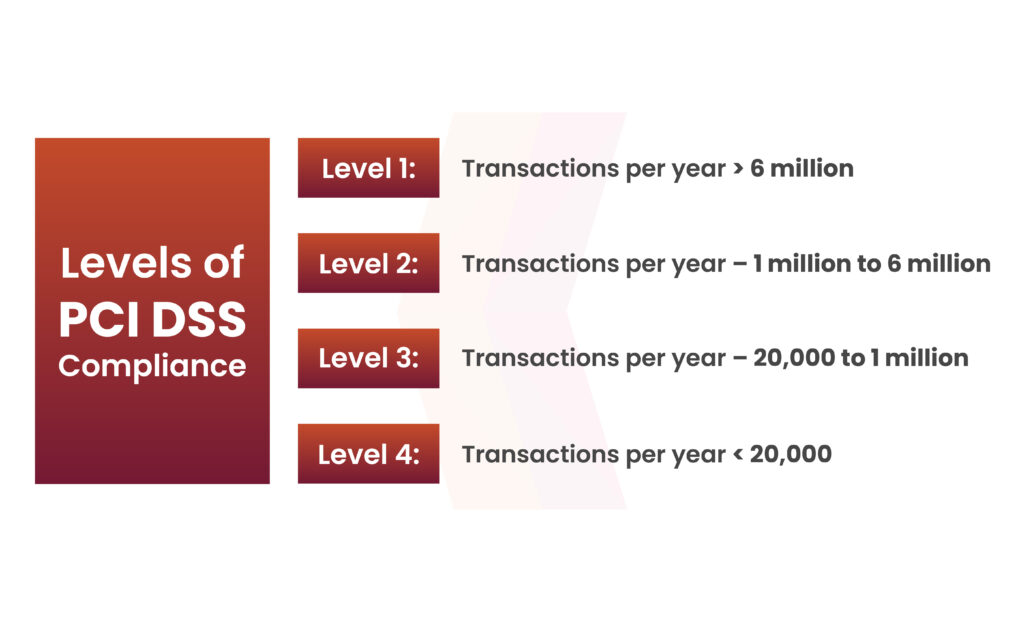

Furthermore, businesses must determine their PCI compliance level based on the volume of online transactions processed annually. The PCI Council has categorized four compliance levels, each with specific requirements that must be met to achieve certification. Depending on their compliance level, businesses may need to engage a PCI-qualified security assessor to conduct an audit, submit an annual compliance report, or complete a Self-Assessment Questionnaire (SAQ) to affirm their adherence to PCI standards.

Conducting a thorough security assessment, identifying potential vulnerabilities, and implementing appropriate security measures are essential steps in preparing for PCI DSS compliance certification. External Qualified Security Assessors (QSAs) are appointed to evaluate a company’s security controls, policies, and procedures, highlighting areas of improvement and ensuring compliance with the 12 PCI DSS requirements.

In conclusion, obtaining PCI compliance certification is a critical component of protecting sensitive cardholder data, maintaining customer trust, and avoiding financial penalties associated with non-compliance. By following the prescribed PCI standards, conducting security assessments, and collaborating with qualified auditors, businesses can enhance their security posture, mitigate data breach risks, and uphold the integrity of their operations.